crypto tax calculator nz

1 Add data from hundreds of sources Directly upload your transaction history via CSV or API. If you are using ACB Adjusted cost base method the cost basis of sale will be determined by.

Brazil Sales Tax Rate Vat 2022 Data 2023 Forecast 2006 2021 Historical Chart

Calculate Your Crypto DeFi and NFT Taxes in as little as 20 minutes.

. In this example the cost basis of the 2 BTC disposed would be 35000 10000 500002. The cost basis of the 2 BTC disposed is therefore 40000 2 x 10000 500003 in this example. Tax reports No more.

Crypto Tax Calculator Plans Pricing All plans include coverage for every type of crypto transaction including but not limited to DeFi DEXs derivatives and staking as well as. This new rate applies from 1st April. Quick simple and reliable.

Some cryptoasset transactions may. Whether youre a crypto newbie or a full-blown degen we have pricing options available for everyones needs and transaction amounts. Calculate the New Zealand dollar value of your cryptoasset transactions work out your cryptoasset income and expenses.

We provide tailored and proactive cryptocurrency tax advice to all clients anywhere throughout New Zealand. Whether youre a crypto newbie or a full-blown degen we have pricing options available for everyones needs and transaction amounts. Crypto Tax Calculator for Australia.

Tax agent status Te tūnga māngai tāke. Calculating the New Zealand dollar value of cryptoassets You need to use amounts in New Zealand dollars NZD when filing your income tax return. Find the right crypto tax calculator to help do your crypto taxes in New Zealand.

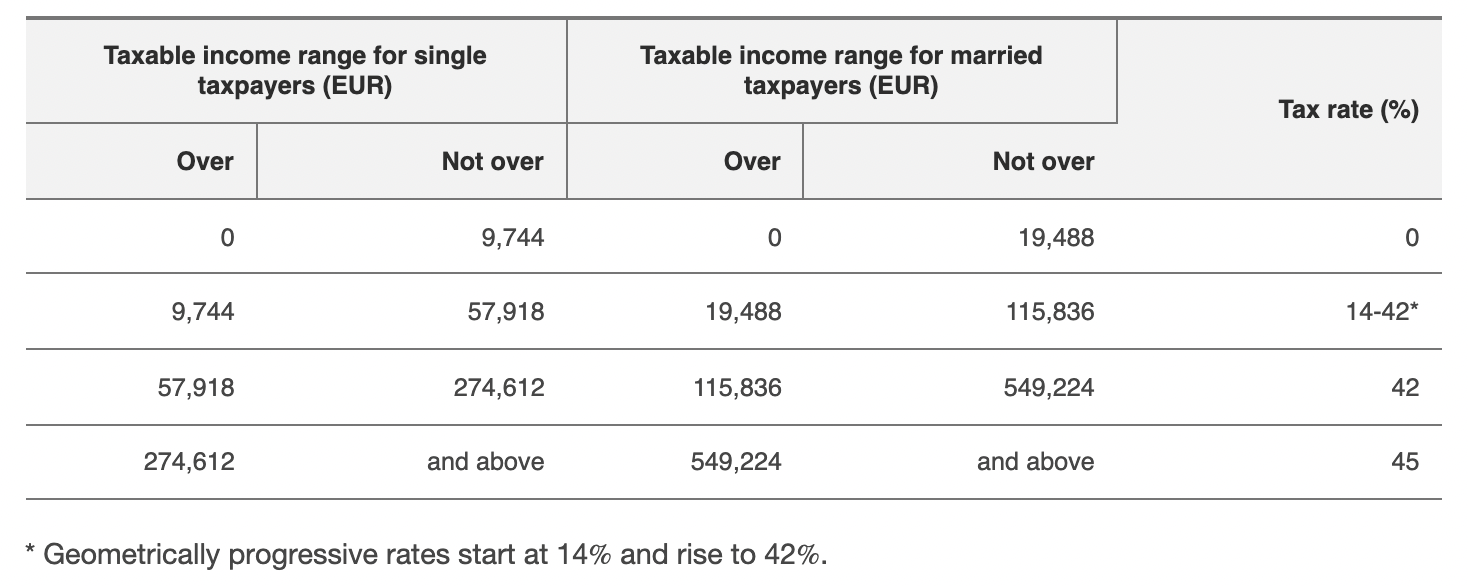

Jonas has an income of. If you held cryptoassets that were stolen you may be able. New Zealand has a progressive tax rate system and the tax rates.

The Inland Revenue service makes it clear that. Extension of time arrangements Te whakaroa i ngā whakaritenga wā. Built to comply with Aussie tax standards.

The amount of tax you need to pay depends on how much income you have. Crypto received from activities such as mining staking and airdrops also attract Income Tax in most cases. Check out this table to know how to calculate your taxes.

In New Zealand you will primarily be paying income tax on your crypto income. Compare different crypto tax softwares by compatibility with exchanges like Binance Coinbase FTX. Filing your crypto taxes in New Zealand Koinly helps New Zealanders calculate their income from crypto trading mining etc.

Our crypto tax calculator software can help you aggregate all of your crypto transaction data to help calculate any gains losses income andor expenses. Contact us to ensure you are prepared for tax and have the right strategy in. Taxoshi NZs Crypto Tax Caluclator Founded by the mighty Craig MacGregor co-founder of Navcoinand a legend in the NZ Crypto scene Taxoshiis a homegrown tax calculation service.

Therefore crypto is taxed at your regular income tax rate. CryptoTaxCalculator helps ease the pain of preparing your crypto taxes in a few easy steps. Taxoshi NZs Crypto Tax Caluclator Founded by the mighty Craig MacGregor co.

Managing consolidated groups Te whakahaere rōpū tōpū. Sort out your crypto tax.

Cryptocurrency Tax Basics Cryptocurrency Tax Nz

How Does Germany Taxes Crypto How Much Tax Do You Pay On Crypto In Germany Is It Really Tax Free

Japan S Regulator Suggests Crypto Tax Breaks For Crypto Investors Crypto News

11 Best Crypto Tax Calculators To Check Out

Best Crypto Tax Software For New Zealand

%20(1).jpg)

Crypto Tax Rates Complete Breakdown By Income Level 2022 Coinledger

Koinly Vs Coinledger Io Ex Cryptotrader Tax Which Tax Calculator Is Better Captainaltcoin

![]()

Taxoshi Get Your Crypto Tax Under Control

I Built An Income Tax Calculator Using Formidable Forms For The Cook Islands Govcrate Blog

7 Best Crypto Tax Software To Calculate Taxes On Crypto Thinkmaverick

11 Best Crypto Tax Calculators To Check Out

Tax On Investments And Savings In A Nutshell Moneyhub Nz

Cryptocurrency Tax In New Zealand How Does It Work R Nzbitcoin

Crypto Tax Calculator Koinly Integrates Terra Into Its Platform Blockchair News